Do You Pay Taxes on Lawsuit Settlements?

When you receive money from a lawsuit settlement, you may or may not have to pay taxes on the amount of the settlement. If you are unsure about a lawsuit that you are dealing with, call us for top-rated help from Atlanta’s leading workers’ compensation lawyer. Whether or not your settlement is taxed depends on a few factors, the main one being if you are making a personal injury claim, or some other type of lawsuit. Let’s examine how lawsuit settlements are taxed by the government more closely.

How Are Lawsuit Settlements Taxed?

Generally speaking, most lawsuit settlements are viewed as income by the Internal Revenue Service (IRS), and are taxed accordingly. However, award settlements for personal injury cases are not legally taxable — the IRS states that you must have suffered “observable bodily harm” in order for a lawsuit settlement to be considered tax-free under the rule of law. Emotional distress is not considered to be a physical injury on its own, but if medical attention is sought for emotional distress — like with a counselor or therapist — those sessions could be tax-free, depending on the circumstances. Let us know if you have questions about an injury that you are planning on filing a lawsuit for. Our dedicated legal team can help you determine whether you will have to pay taxes on a potential award settlement.

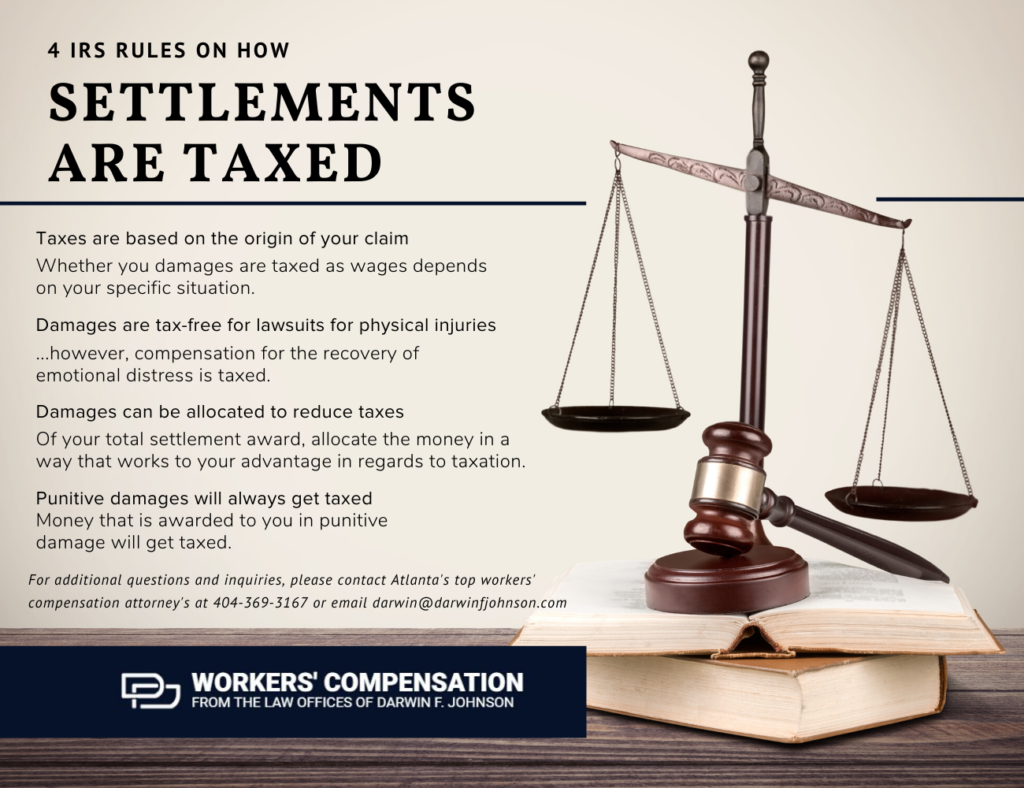

Take a look at the infographic below for a quick overview of IRS rules regarding taxation on lawsuits:

Contact Workers Compensation from the Law Offices of Darwin F. Johnson to Learn More

If you want help from Atlanta’s leading workman’s comp attorney, look no further than Workers Compensation from the Law Offices of Darwin F. Johnson. Our highly-experienced legal team has the skills and resources needed to help you file a claim and get the compensation you deserve. Reach out to us any time to learn more about the process of taxing workers compensation claims, and to find out if your claim will be taxed by the IRS.

Workers' Compensation

Workers' Compensation